How Social Media Sentiment Affects Stock Market Performance

28 December 2024

If I told you that your next stock trade could be influenced by tweets, viral memes, or even TikTok videos, would you believe it? Welcome to the modern world of investing, where social media plays a larger role in the stock market than many of us ever imagined. Gone are the days when only financial statements and Wall Street analysts moved markets. Now, a trending hashtag or a Reddit post could spark a buying frenzy or a massive sell-off.

But how exactly does social media sentiment—people’s opinions, emotions, and reactions online—impact stock market performance? Let’s dive in, explore the dynamics, and see how this digital phenomenon affects investors like you and me.

Social Media and the Stock Market: A Match Made in Chaos

Social media platforms have evolved into more than just places to share dog pictures or argue about pineapple on pizza. They’ve become real-time barometers of public sentiment—and guess what markets thrive on? Sentiment.Think of the stock market like a mood ring for the economy. The more positive people feel about a company or its prospects, the more likely its stock price is to go up. On the flip side, panic, doubt, or controversy can tank a stock’s value faster than you can hit the “share” button. Social media amplifies these emotions, often creating a feedback loop.

The Power of the Crowd

Remember the GameStop frenzy in early 2021? That was social media sentiment in action. A group of retail investors on Reddit’s r/WallStreetBets banded together, hyped up the stock, and sent shares soaring over 1,700%. Suddenly, Wall Street hedge funds that were betting against GameStop were left scrambling to cover their losses.This wasn’t some fluke event. It highlighted the sheer power of collective sentiment fueled by platforms like Reddit, Twitter, and even Facebook. When enough people believe in a narrative—whether it’s “this stock is undervalued” or “let’s stick it to the suits”—it can directly impact stock prices.

But here’s the kicker: these movements aren’t always driven by logic or fundamentals. They’re based on emotion. And that brings us to how volatile and unpredictable social-media-driven trading can be.

Real-Time Sentiment: A Blessing and a Curse

Social media provides up-to-the-minute reactions to news, events, and even rumors. In some ways, this is a blessing for investors. You can gauge how people feel about a company almost instantly.But it also comes with a downside. Emotional reactions on social media tend to be knee-jerk—think of it like a shortcut to panic. Let’s say a false rumor about a company goes viral. Before you know it, people start selling, and the stock plummets. By the time the rumor is debunked, the damage has already been done.

Social media doesn’t just amplify emotions—it accelerates them. A news cycle that might have taken days or weeks to unfold in the past now plays out in hours, or even minutes.

The Role of Influencers and Key Voices

Another layer to consider: Not all social media sentiment comes from regular folks like you and me. Many influential personalities—from Twitter's finance gurus to YouTube stock analysts—have built massive followings. When someone like Elon Musk tweets about Dogecoin or Bitcoin, markets move.Here’s why this matters: People trust influencers. They see them as experts, even if they don’t always have the credentials to back it up. When these influencers talk positively (or negatively) about a stock or sector, their followers often act on it. This can create a spike in demand—or panic selling—regardless of whether the stock’s fundamentals justify it.

And let’s face it, sometimes these high-profile tweets and posts are more about drama than substance. But the market? It reacts just the same.

Sentiment Analysis: Turning Emotions into Data

Okay, so we’ve talked about how social media sentiment can impact the market, but here’s the million-dollar question: How do you measure something as intangible as online emotions? Enter sentiment analysis.Sentiment analysis uses artificial intelligence and machine learning to sift through social media posts, tweets, forums, and news articles. It categorizes the sentiment as positive, negative, or neutral. Investors and analysts use this data to predict how markets might respond.

For example, if a bunch of tweets about a company are glowing with excitement, it might signal an upcoming rally in its stock price. Conversely, a flood of negative sentiment could indicate trouble ahead.

But sentiment analysis isn’t perfect. It can misinterpret sarcasm or context (imagine trying to analyze a joke on Twitter—it’s not easy!). Still, it’s becoming an increasingly popular tool for traders trying to get an edge in today’s lightning-fast market.

Does Sentiment Always Align with Fundamentals?

Now, this is where things get tricky. Ideally, a company’s stock price should reflect its true value, based on earnings, revenue, and other financial metrics. But social media sentiment often pushes prices far above—or below—their fundamental worth.Take Tesla as an example. The stock’s valuation has often been disconnected from its financial performance, thanks in part to Elon Musk’s cult-like following on Twitter. Sure, Tesla is a groundbreaking company, but its stock has been subject to wild swings driven by Musk’s tweets and the fervor of its fanbase.

This disconnect between sentiment and fundamentals can lead to bubbles. Remember that saying, “What goes up must come down”? When stocks are driven purely by hype, the crash can be just as dramatic as the rise.

How Can Investors Navigate the Social Media Maze?

So, what should you do if you’re an investor in today’s social-media-driven market? Here are a few tips to keep your head above water:1. Don’t Believe the Hype Too Quickly

Not everything you see on Twitter or Reddit is gold. Just because a stock is trending doesn’t mean it’s a good investment. Do your own research and dig into the fundamentals before making a move.2. Use Sentiment as a Tool, Not a Gospel

Social media sentiment can be a helpful indicator, but it’s just one piece of the puzzle. Combine it with other forms of analysis—like technical and fundamental analysis—to get a clearer picture.3. Beware of Herd Mentality

When everyone’s piling into a stock, it can be tempting to jump in too. But remember: the larger the crowd, the more inflated the price, and the riskier the investment.4. Stay Calm During Emotional Swings

Social media can turn small market dips into full-blown panic attacks. As an investor, your best bet is to remain level-headed. Don’t make rash decisions based on what’s trending.5. Follow Trusted Sources

Separate the credible voices from the noise. Follow analysts, reputable financial sites, and experts who provide balanced and well-informed takes, rather than just chasing hype.The Future of Social Media and Stock Markets

As social media continues to evolve, its influence on the stock market will only grow. Platforms are already experimenting with integrating finance tools—like Twitter’s stock tickers or Reddit’s growing finance communities.But with great power comes great responsibility. Regulators are starting to keep a closer eye on how social media is used to manipulate markets. After all, as GameStop and other incidents have shown, unchecked sentiment can lead to massive disruptions.

For us as investors, one thing is clear: Understanding social media sentiment isn’t just optional anymore—it’s becoming a crucial part of navigating today’s financial world.

Conclusion

Social media sentiment is like a double-edged sword in the stock market. On one hand, it democratizes information and allows anyone to influence markets. On the other hand, it introduces volatility, hype, and emotion into a space that ideally should be based on logic and analysis.In the end, the key to surviving—and thriving—in this new era of investing is balance. Use social media wisely, stay informed, and keep your wits about you when the market starts moving at the speed of a meme. Remember: the market might be influenced by tweets, but your success as an investor depends on your strategy.

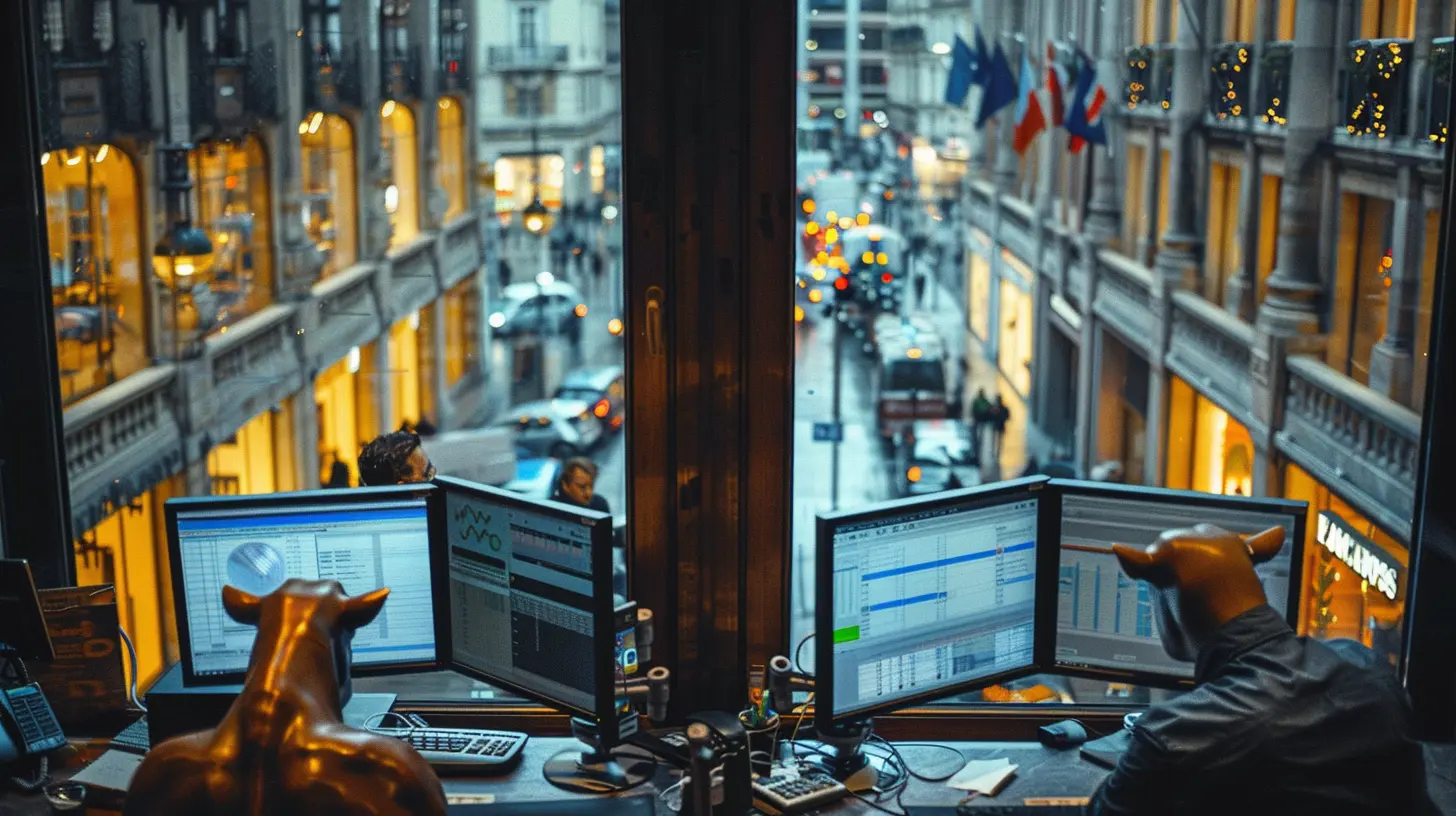

all images in this post were generated using AI tools

Category:

Stock MarketAuthor:

Harlan Wallace

Discussion

rate this article

17 comments

Vito McIntyre

This article brilliantly highlights the powerful connection between social media sentiment and stock market fluctuations. It's fascinating how collective emotions can influence investment decisions. Understanding this relationship is crucial for both investors and companies looking to navigate today’s dynamic market landscape.

February 15, 2025 at 4:16 AM

Harlan Wallace

Thank you for your insightful comment! I'm glad you found the connection between social media sentiment and stock market performance compelling. Understanding these dynamics is indeed vital for investors and companies alike.

Declan Hensley

This article brilliantly highlights the fascinating interplay between social media sentiment and stock market dynamics. It's a reminder of how interconnected our world is, and how collective emotions can shape financial outcomes. Thank you for shedding light on this timely and relevant topic!

February 4, 2025 at 11:54 AM

Harlan Wallace

Thank you for your thoughtful comment! I'm glad you found the connections between social media sentiment and stock market dynamics insightful.

Myles Romero

This article compellingly highlights the correlation between social media sentiment and stock market performance, emphasizing how public perception can significantly influence investment decisions and market trends. Great insights!

January 31, 2025 at 3:33 AM

Harlan Wallace

Thank you for your kind words! I'm glad you found the insights valuable.

Bennett Schultz

Great insights! This article highlights the powerful connection between social media sentiment and stock market performance. It's a reminder that every tweet and post can influence our investment landscape. Stay informed and harness the collective voice for smarter financial decisions!

January 26, 2025 at 1:55 PM

Harlan Wallace

Thank you! I'm glad you found the article insightful. Indeed, social media sentiment plays a crucial role in shaping market dynamics. Staying engaged with these trends can lead to more informed investment strategies!

Ainsley Cummings

Social media is revolutionizing finance! Understanding sentiment empowers investors to navigate market fluctuations. Embrace this dynamic landscape—success favors those who adapt and engage!

January 23, 2025 at 12:35 PM

Harlan Wallace

Absolutely! Social media sentiment is a game-changer for investors, offering real-time insights that can significantly influence market trends. Adapting to this dynamic environment is crucial for success.

Isaac Rodriguez

Fascinating concept! I wonder how exactly social media sentiment translates to stock movements. Are there specific platforms or types of posts that have a stronger influence? Curious to see more data on this!

January 20, 2025 at 4:23 AM

Harlan Wallace

Thank you for your interest! Social media sentiment can significantly influence stock movements, particularly on platforms like Twitter and Reddit, where real-time discussions drive investor sentiment. Posts that generate high engagement or virality often have a stronger impact. We'll explore more data in future updates!

Wren Schultz

This article provides a compelling look at the intersection of social media and stock market dynamics. It’s fascinating how collective sentiment online can sway market trends, sometimes overshadowing fundamental analysis. Investors need to be cautious—while social media can offer insights, it can also fuel irrational market behavior.

January 13, 2025 at 8:22 PM

Harlan Wallace

Thank you for your insightful comment! Indeed, the influence of social media on market dynamics highlights the importance of balancing sentiment analysis with fundamental data. Caution is key for investors navigating this complex landscape.

Lark Wyatt

Social media sentiment is a powerful force in the stock market, shaping perceptions and driving trends. Embrace the digital landscape—understanding it can unlock unprecedented investment opportunities!

January 5, 2025 at 9:12 PM

Harlan Wallace

Absolutely! Social media sentiment plays a crucial role in influencing market trends and investor behavior. Harnessing this understanding can indeed lead to unique investment opportunities. Thank you for your insights!

Mateo Allen

Fascinating topic! I'm intrigued by the connection between social media sentiment and stock trends. How do you quantify the impact of tweets or posts on market movements? Would love to learn more!

December 31, 2024 at 9:09 PM

Harlan Wallace

Thank you for your interest! We quantify the impact of tweets and posts on market movements by analyzing sentiment scores using natural language processing and correlating these scores with stock price fluctuations. Stay tuned for more insights in the full article!

Ximena Schultz

This article effectively highlights the intricate relationship between social media sentiment and stock market movements. Understanding this dynamic is crucial for investors, as emotional trends can significantly influence market behavior, often leading to unexpected volatility and investment opportunities.

December 31, 2024 at 1:54 PM

Harlan Wallace

Thank you for your insightful comment! I'm glad you found the article helpful in understanding the impact of social media sentiment on stock market performance.

Bear Hernandez

Social media sentiment influences market psychology, driving stock price fluctuations.

December 31, 2024 at 4:54 AM

Harlan Wallace

Absolutely! Social media sentiment plays a crucial role in shaping market perceptions and can lead to significant stock price volatility.

Capri Henderson

This article effectively highlights the growing influence of social media sentiment on stock market performance. As investors increasingly rely on online opinions, understanding this relationship is crucial for making informed trading decisions. Well done!

December 30, 2024 at 7:55 PM

Harlan Wallace

Thank you for your thoughtful comment! I'm glad you found the article insightful. Understanding this dynamic is indeed essential for today’s investors.

Olive Gonzalez

Great insights! Understanding social media's impact on stock sentiment is crucial for savvy investing in today's digital age.

December 30, 2024 at 1:45 PM

Harlan Wallace

Thank you! I'm glad you found the insights valuable. Social media plays a pivotal role in shaping market sentiment, and understanding this influence is key for investors today.

Georgina Thomas

The interplay between social media sentiment and stock market performance underscores the growing influence of retail investors. Analyzing sentiment can provide insights into market trends; however, the volatility it introduces also raises questions about market efficiency and the traditional roles of analysis and fundamentals in investing strategies.

December 29, 2024 at 11:30 AM

Harlan Wallace

Thank you for your insightful comment! Indeed, the rise of retail investors and the impact of social media sentiment on stock market dynamics highlight the evolving landscape of investing, challenging traditional analysis methods.

Runeveil Clayton

Social media is the new trading floor. Investor sentiment swings wildly with tweets and posts, driving stock prices to dizzying heights or gut-wrenching lows. Embrace the chaos—those who ignore this digital pulse risk being left behind in today's fast-paced market.

December 28, 2024 at 9:33 PM

Harlan Wallace

Absolutely! Social media has revolutionized market dynamics, making investor sentiment a key driver of stock performance. Adapting to this new landscape is essential for staying competitive.

Talis Barlow

Great insights on the interplay between social media sentiment and stock market performance! It's fascinating to see how public perception can influence financial trends. Staying informed and adaptable is key in this dynamic landscape. Keep up the excellent work!

December 28, 2024 at 11:18 AM

Harlan Wallace

Thank you for the kind words! I'm glad you found the insights valuable. Staying adaptable is indeed crucial in today's fast-paced environment.

Willow Lynch

Great article! It's fascinating how social media sways market trends. Remember, while sentiment can be fickle, keeping a cool head and doing your research is key! 🤑📈

December 28, 2024 at 3:58 AM

Harlan Wallace

Thank you! I'm glad you enjoyed it. You're absolutely right—staying grounded and informed is crucial in navigating the influence of social media on the market.

MORE POSTS

Rebalancing Your Stock Portfolio: Why, When, and How

Speculative Investing and the Art of Timing

Preparing for Major Life Events: Weddings, Babies, and Homeownership

Capital Gains and the Buy-and-Hold Investment Strategy

How to Balance Retirement Savings and Other Financial Goals

Stock Buybacks Explained: What They Mean for Investors

The Inflation-Employment Trade-Off: Why Wages May Not Keep Up

Insider Tips for Getting Approved for High-Limit Credit Cards

How to Safeguard Your Retirement Savings Against Recession

How to Rebalance Your Portfolio for Retirement in a Volatile Market

How to Avoid Credit Card Scams and Phishing Schemes